Patriotism is the last refuge of a scoundrel.

- Samuel Johnson

Friday, April 28, 2006

Friday, April 21, 2006

Undefeated

"When I despair, I remember that all through history the way of truth and love has always won. There have been tyrants and murderers and for a time they seem invincible, but in the end, they always fall - think of it, always."

--Mahatma Gandhi

--Mahatma Gandhi

Thursday, April 20, 2006

http://www.waynemadsenreport.com/

April 20, 2006 -- Beating Bush's NSA e-mail surveillance simple. According to NSA sources, there is a simple method to avoid having one's e-mail captured by NSA Internet filters that have been installed within major Internet exchanges, such as the AT&T facility in San Francisco, which is the subject of a class action suit against AT&T. By typing "Viagra" or "Cialis" in the message text, the filters will automatically identify the e-mail as spam and ignore it. The e-mail could contain the words "Al Qaeda" or "Bin Laden," but as long as Viagra or Cialis are also contained in the text, the e-mail will pass through the filters without being intercepted.

Beating NSA e-mail surveillance -- use the "blue pill" and your e-mail will not go down the rabbit hole.

Beating NSA e-mail surveillance -- use the "blue pill" and your e-mail will not go down the rabbit hole.

good advice

If you don't like the answers you seem to be getting, try asking different questions.

If you don't like the conversations you are holding, try talking to other people.

If you are not pleased with the hand you have been dealt, see if you can swap it or negotiate for some other set of opportunities and challenges.

No matter what obstacles are in your path now, there is also fluidity and flexibility.

Nothing has to be the way that it has been in the past, unless you want to preserve it.

If you don't like the conversations you are holding, try talking to other people.

If you are not pleased with the hand you have been dealt, see if you can swap it or negotiate for some other set of opportunities and challenges.

No matter what obstacles are in your path now, there is also fluidity and flexibility.

Nothing has to be the way that it has been in the past, unless you want to preserve it.

Wednesday, April 19, 2006

Dow/Gold ratio implies we are only halfway through bull cycle

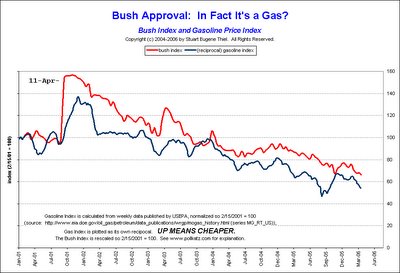

Tuesday, April 11, 2006

Monday, April 10, 2006

Saturday, April 08, 2006

edan "promised land"

out the dungeon of brain pain, I came, with a sell-a-lot plot from the

megawatt mainframe-

with a suit made of electricity, I ran through the Great Wall of China,

convincingly-

that was after the world tour, when I travelled through gravel and battled

matter at the earth's core-

I did the show on a fireball, a pioneer, ran into the jungle and jetted

wearing a lion's ear-

I fought fear with the hammer Thor lent me, and tangled with the Angel of

Death for four centuries-

put a name-plate on the asteroid belt and I ran through the future with an

android's help-

that's when civilians were made of metal. I received a coronation 'cause I

had the last flower petals-

my power settled a clash between races and put good people on the magazine

faces-

substituted television scandals with elephants and pandas, tell 'em its the

elegant commando-

with a hand so big, I punched the Sphinx in the nose, and the nose

decomposed, and so the story goes...

I slapped a 40 o(z) out of a young man's hand and fed him lessons of life to

formulate a plan-

I wore the prime meridian as a wristband, and gave a my riches, but I still

remained a rich man-

the quicksand I witstood, for good, as I hopped a dragonfly to outer space

and met Count Bass....

megawatt mainframe-

with a suit made of electricity, I ran through the Great Wall of China,

convincingly-

that was after the world tour, when I travelled through gravel and battled

matter at the earth's core-

I did the show on a fireball, a pioneer, ran into the jungle and jetted

wearing a lion's ear-

I fought fear with the hammer Thor lent me, and tangled with the Angel of

Death for four centuries-

put a name-plate on the asteroid belt and I ran through the future with an

android's help-

that's when civilians were made of metal. I received a coronation 'cause I

had the last flower petals-

my power settled a clash between races and put good people on the magazine

faces-

substituted television scandals with elephants and pandas, tell 'em its the

elegant commando-

with a hand so big, I punched the Sphinx in the nose, and the nose

decomposed, and so the story goes...

I slapped a 40 o(z) out of a young man's hand and fed him lessons of life to

formulate a plan-

I wore the prime meridian as a wristband, and gave a my riches, but I still

remained a rich man-

the quicksand I witstood, for good, as I hopped a dragonfly to outer space

and met Count Bass....

Thursday, April 06, 2006

Gold hits $600/oz.

“You can observe a lot by watching. We made too many wrong mistakes.”-Yogi Berra

The following points are my opinions and I stand ready to argue about them all day. You may disagree with me, but try to keep an open mind and carefully review this market fundamentals list. Also, think about the implications of these market viewpoints.

By Roger Wiegand

March 30, 2006

(1) Government news and policy is either wrong, damaging or both. Smart traders most always go opposite the news. M-3 measurement of cash is now unpublished. Why is this? We think to simply hide the scary numbers. 2. Oil is not plentiful and prices are going higher. Supply is not going down. Usage is going up. (3) Iraq was all about oil. Iran and Syria are next on the oil hit list. Syria is a walk-over, but Iran is formidable. (4) The US Dollar is going down in the long term, up in the short term. (5) Interest rates are mildly up in the short term and then are flat to down. (6) We have both inflation and deflation right now. Confusion reigns as observers do not know which one has the power. Answer-They both do for today. Either we get an inflationary blow-off followed by deflation or we get deflation. The end game is depression. Is the world ending? No it is not. It’s just getting a bit nasty for a few years until this big mess goes through its historical cycle then life goes on.

(7) Swiss Francs and Canadian Dollars are going up. The Euro is going up then down, and then disappears. (8) Gold and silver are going up. (9) Inflationary daily life will become much tougher. (10) All government from the lowest to the highest will not belt tighten like us little folks. They will grab for more and take more. (11) If the grabbing becomes too pushy, consumers will push back. (12) Crime will sky rocket as will unemployment. (13) Cash becomes king while debt a millstone on your neck. Then, gold and silver will become the king of kings. 14) Paper of all kinds, notes, mortgages, loans, etc. become worthless or worth less. (15) Today’s events are like the 1930’s. The Nasdaq implosion was identical to 1929. Today, we are preparing for the next wave of selling after a bear market bounce. We will get at least two more head fake bear market rallies in the race to the bottom for mainstream stocks. Next will resemble 1937 in market action which was negative.

(16) Professional stock market people are dumping securities with both hands into each buying rally. (17) The Sheeple are encouraged to buy the dips so the pros can use the rallies to sell out. (18) Overpaid CEO’s are selling stock with both hands and running with the money. Many then retire for “family and personal reasons.” (19) Even small accounts can make big winnings if you are on the right side of the trade. (20) Loose lips sink ships. Don’t sink your ship. Act poor and live comfortably.

(21) GM has lost over $10 billion for 2005. Their cash flow is a negative $3 billion and they lost $8 billion net excluding accounting problems. Their annual healthcare expenditure equaled the net loss of $8 billion. WSJ reports they must downsize and close four plants. Now they say 12 plants. They offered buyouts to retire 35,000 employees. They need to shed 45-85,000 jobs and 25 plants but the unions will not permit it. They will be headed to bankruptcy court in late 2006 or 2007 when union contract talks enter stalemate. Annual healthcare costs are $10,000 per current or retired employee. All corporations will be seeking to escape health care expenses partially or entirely. Look for repudiated pensions and healthcare liabilities to be dumped on the federal government. The government’s pension bail-out fund is now broke. They will just print more cash to cover accelerating costs.

(22) The March PPI rose 0.7% in 2005 the highest in four months. Energy costs are the main driver. Oil is holding in the $64.50-66.50 range as we forecast. Unleaded fuel this summer or early fall will be +$3.00 at the pump due to refinery shortages as we reported. Within 18 months gas will be $5 a gallon. Oil is going to $85 a barrel within 12 months or less. Attacks on Syria and Iran could cause it to rise sooner. We expect the violence to begin sometime in 2006 to prevent Iran from using an atomic bomb on New York City. Iran has a big military that could be severely damaged. Israel and the US Stryker Forces are on maneuvers right now in southern Israel. This forecast could be obviated as news is now saying back door talks with the USA and Iran are in process and things are cooling down. (23) The support level for the Dow is 10,400-10,000 and a blow-off top is 11,400. After the 10,000 low is secured, look for 9350 next. A selling slide is imminent.

(24) Hugo Chavez is raising his oil tax on Venezuelan oil producers from 34% to 50%. After he gets away with that, then expect him to steal it all. He and Fidel are spoiling for trouble all over South America. Any foreign corporation operating in Venezuela will be a target for government theft. Indonesia has also joined this anti-business crowd. Expect other countries to follow suit as the bold become bolder in their taking-stealing efforts. (25) Middle Eastern oil rich nations are buying gold more rapidly. These same countries feel abused by the USA and are moving to trade oil in Euros and other non-USA currencies which is very big trouble. (26) Thoughtless American senators, wrangling for attention and votes are running around harassing China and other nations over currency and trade protectionist matters which ensure throwing gasoline on the USA trade deficit making life miserable for American business people.

(27) Grain is suffering from a 100 year global drought and is hitting north China particularly hard. Grain is energy powered. Everything from fertilizer, to seeds, tractors, harvesting machines and market transport will take a cheap food commodity and make it costly. World-wide supplies of grain are at 30 year lows. Supply and demand will eventually prevail. Global weather has entered one of its historically nasty cycles creating havoc for growers and insurance companies.

(28) The precious metals have a long way to rise in price. There will be ups and downs throughout the trade as there are in any market. Naysayers will try to drive you out as these rally markets can wound and perhaps kill “other status quo markets.” It’s going to be you or them. I would rather it be them and get our economy back on solid footing once more. The news is wrong and twisted to promote the status quo viewpoint. Do not ever forget this.

At its extreme, gold is on a one way track to $2,960. Modestly, the top could be $1,250. Currently, gold and silver are topping but stubbornly holding higher prices and refusing to correct. We either get a mild correction and subsequent major rally, or a larger correction followed by the same major rally. History repeats again and again. As of 3-30-06, it appears we are seeing a new gold and silver market beginning to rally.

How to Cope and be Comfortable

It will not hurt anybody to get out of debt, lower life style expectations and take steps to protect your future. If I am totally wrong what can you lose? If I am right and you stay with the status quo, what does your future look like? Don’t let the enemies of gold run you off. Hold your gold and have strength of purpose. Remember, that first of all the fundamentals mandate gold and history tells us precious metals are the place to win for several more years. –Trader Rog

The following points are my opinions and I stand ready to argue about them all day. You may disagree with me, but try to keep an open mind and carefully review this market fundamentals list. Also, think about the implications of these market viewpoints.

By Roger Wiegand

March 30, 2006

(1) Government news and policy is either wrong, damaging or both. Smart traders most always go opposite the news. M-3 measurement of cash is now unpublished. Why is this? We think to simply hide the scary numbers. 2. Oil is not plentiful and prices are going higher. Supply is not going down. Usage is going up. (3) Iraq was all about oil. Iran and Syria are next on the oil hit list. Syria is a walk-over, but Iran is formidable. (4) The US Dollar is going down in the long term, up in the short term. (5) Interest rates are mildly up in the short term and then are flat to down. (6) We have both inflation and deflation right now. Confusion reigns as observers do not know which one has the power. Answer-They both do for today. Either we get an inflationary blow-off followed by deflation or we get deflation. The end game is depression. Is the world ending? No it is not. It’s just getting a bit nasty for a few years until this big mess goes through its historical cycle then life goes on.

(7) Swiss Francs and Canadian Dollars are going up. The Euro is going up then down, and then disappears. (8) Gold and silver are going up. (9) Inflationary daily life will become much tougher. (10) All government from the lowest to the highest will not belt tighten like us little folks. They will grab for more and take more. (11) If the grabbing becomes too pushy, consumers will push back. (12) Crime will sky rocket as will unemployment. (13) Cash becomes king while debt a millstone on your neck. Then, gold and silver will become the king of kings. 14) Paper of all kinds, notes, mortgages, loans, etc. become worthless or worth less. (15) Today’s events are like the 1930’s. The Nasdaq implosion was identical to 1929. Today, we are preparing for the next wave of selling after a bear market bounce. We will get at least two more head fake bear market rallies in the race to the bottom for mainstream stocks. Next will resemble 1937 in market action which was negative.

(16) Professional stock market people are dumping securities with both hands into each buying rally. (17) The Sheeple are encouraged to buy the dips so the pros can use the rallies to sell out. (18) Overpaid CEO’s are selling stock with both hands and running with the money. Many then retire for “family and personal reasons.” (19) Even small accounts can make big winnings if you are on the right side of the trade. (20) Loose lips sink ships. Don’t sink your ship. Act poor and live comfortably.

(21) GM has lost over $10 billion for 2005. Their cash flow is a negative $3 billion and they lost $8 billion net excluding accounting problems. Their annual healthcare expenditure equaled the net loss of $8 billion. WSJ reports they must downsize and close four plants. Now they say 12 plants. They offered buyouts to retire 35,000 employees. They need to shed 45-85,000 jobs and 25 plants but the unions will not permit it. They will be headed to bankruptcy court in late 2006 or 2007 when union contract talks enter stalemate. Annual healthcare costs are $10,000 per current or retired employee. All corporations will be seeking to escape health care expenses partially or entirely. Look for repudiated pensions and healthcare liabilities to be dumped on the federal government. The government’s pension bail-out fund is now broke. They will just print more cash to cover accelerating costs.

(22) The March PPI rose 0.7% in 2005 the highest in four months. Energy costs are the main driver. Oil is holding in the $64.50-66.50 range as we forecast. Unleaded fuel this summer or early fall will be +$3.00 at the pump due to refinery shortages as we reported. Within 18 months gas will be $5 a gallon. Oil is going to $85 a barrel within 12 months or less. Attacks on Syria and Iran could cause it to rise sooner. We expect the violence to begin sometime in 2006 to prevent Iran from using an atomic bomb on New York City. Iran has a big military that could be severely damaged. Israel and the US Stryker Forces are on maneuvers right now in southern Israel. This forecast could be obviated as news is now saying back door talks with the USA and Iran are in process and things are cooling down. (23) The support level for the Dow is 10,400-10,000 and a blow-off top is 11,400. After the 10,000 low is secured, look for 9350 next. A selling slide is imminent.

(24) Hugo Chavez is raising his oil tax on Venezuelan oil producers from 34% to 50%. After he gets away with that, then expect him to steal it all. He and Fidel are spoiling for trouble all over South America. Any foreign corporation operating in Venezuela will be a target for government theft. Indonesia has also joined this anti-business crowd. Expect other countries to follow suit as the bold become bolder in their taking-stealing efforts. (25) Middle Eastern oil rich nations are buying gold more rapidly. These same countries feel abused by the USA and are moving to trade oil in Euros and other non-USA currencies which is very big trouble. (26) Thoughtless American senators, wrangling for attention and votes are running around harassing China and other nations over currency and trade protectionist matters which ensure throwing gasoline on the USA trade deficit making life miserable for American business people.

(27) Grain is suffering from a 100 year global drought and is hitting north China particularly hard. Grain is energy powered. Everything from fertilizer, to seeds, tractors, harvesting machines and market transport will take a cheap food commodity and make it costly. World-wide supplies of grain are at 30 year lows. Supply and demand will eventually prevail. Global weather has entered one of its historically nasty cycles creating havoc for growers and insurance companies.

(28) The precious metals have a long way to rise in price. There will be ups and downs throughout the trade as there are in any market. Naysayers will try to drive you out as these rally markets can wound and perhaps kill “other status quo markets.” It’s going to be you or them. I would rather it be them and get our economy back on solid footing once more. The news is wrong and twisted to promote the status quo viewpoint. Do not ever forget this.

At its extreme, gold is on a one way track to $2,960. Modestly, the top could be $1,250. Currently, gold and silver are topping but stubbornly holding higher prices and refusing to correct. We either get a mild correction and subsequent major rally, or a larger correction followed by the same major rally. History repeats again and again. As of 3-30-06, it appears we are seeing a new gold and silver market beginning to rally.

How to Cope and be Comfortable

It will not hurt anybody to get out of debt, lower life style expectations and take steps to protect your future. If I am totally wrong what can you lose? If I am right and you stay with the status quo, what does your future look like? Don’t let the enemies of gold run you off. Hold your gold and have strength of purpose. Remember, that first of all the fundamentals mandate gold and history tells us precious metals are the place to win for several more years. –Trader Rog

Wednesday, April 05, 2006

DeLay is done

"So many minority youths had volunteered that there was literally no room for patriotic folks like myself."

- At the 1988 GOP convention, Tom DeLay (R-Scumbag) explains why he and fellow Chickenhawk Dan Quayle (R-Potatoe) did not enlist to fight in the Vietnam war, of which they both were (hypothetically) in favor.

- At the 1988 GOP convention, Tom DeLay (R-Scumbag) explains why he and fellow Chickenhawk Dan Quayle (R-Potatoe) did not enlist to fight in the Vietnam war, of which they both were (hypothetically) in favor.

Subscribe to:

Posts (Atom)

News

Loading...